How ChatGPT can unchain you from mundane office life

GenAI will allow human talent to focus on more creative, complex tasks, leading to greater job satisfaction and well-being....

Audio available

by Jerry Davis Published 16 September 2021 in Supply chain • 7 min read •

In August 2011, Marc Andreessen, venture capitalist and co-founder of Netscape, published a widely read essay in the Wall Street Journal titled, Why Software is Eating the World. He argued that we were “in the middle of a dramatic and broad technological and economic shift in which software companies are poised to take over large swathes of the economy”.

“Over the next 10 years,” he added, “I expect many more industries to be disrupted by software, with new world-beating Silicon Valley companies doing the disruption in more cases than not.”

A decade later, Andreessen’s vision has come true. Information and communication technologies (ICTs) have transformed how companies raise capital, recruit and manage labor, engage their suppliers and distribution channels, and coordinate their internal activities. In the next 10 years, we may see the company itself evaporate in favor of software-based coordination, as the basic categories we use to understand the economy (for example, employee, firm, industry and nationality) fall apart.

We are starting to see this in perhaps the oldest industry of all: restaurants. Accelerated in part by the COVID-19 pandemic and the rise of app-based food delivery services, the restaurant industry may be a portent of a future without firms.

The pervasive spread of the smartphone since 2007 has meant that much of our social life is intermediated by a screen. The pandemic greatly accelerated this shift, particularly during lockdowns, as much of the population went to work or attended school via Zoom, and shopped through Amazon, Doordash or Deliveroo. Those of us living in Silicon Valley grew accustomed to checking the air quality index and COVID-19 prevalence rates before leaving the house. Our knowledge of the world outside our door often came exclusively from apps.

In the next 10 years, we may see the company itself evaporate in favor of software-based coordination, as the basic categories we use to understand the economy fall apart

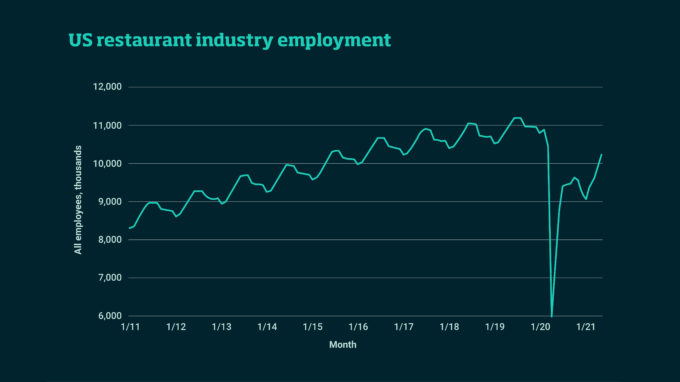

This near-universal online intermediation was great news for a few Big Tech companies. By July 2021, the combined market values of Google, Amazon, Facebook, Apple, and Microsoft made up one-third of the value of the S&P500, and a handful of billionaires galloped toward becoming trillionaires. But a homebound population is a disaster for restaurants. In the US, 100,000 restaurants closed in the first six months of the pandemic, and employment in the industry dropped by five million jobs — roughly the population of Denmark — in a single month. For an industry that has existed at least since the time of Pompeii, this was the equivalent of the meteor that killed off the dinosaurs.

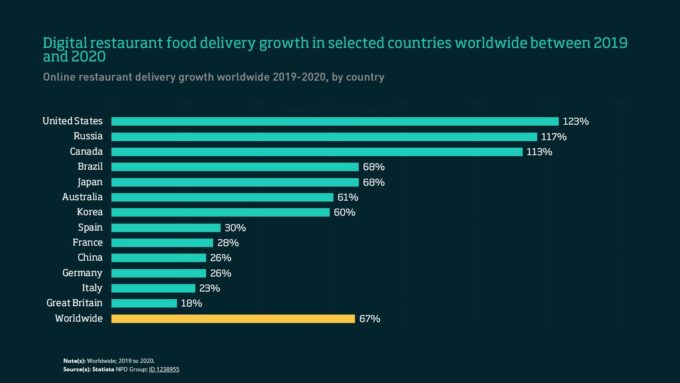

Many restaurants pivoted to takeout, and employment bounced back, although not all the way back. In-person dining was still too risky for many customers, and the proliferation of app-based delivery services — GrubHub, UberEats and DoorDash, among others — meant that nearly any kind of cuisine was available at home. Indeed, every member of the household could have their favorite, averting the inevitable fights over what’s for dinner.

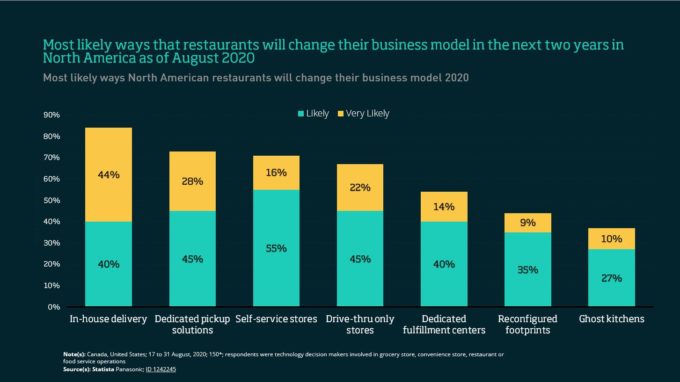

But if customers only know the restaurant from its online menu, why not diversify and cook multiple menus from the same facility? Online-only ordering gave brands an opportunity to try out new identities. Chuck E Cheese, a restaurant better known for its rodent-themed children’s birthday parties than its cuisine, appeared online as Pasqually’s Pizza & Wings, magically destigmatized via the Web.

Much like Nike or Apple, a restaurant can be thought of as a design-focused brand that could contract out production

And if you’re only going to sell takeout, why hang on to pricey real estate at all? Why even hang on to employees? Without ambiance, a restaurant’s real value add is a distinctive recipe book and some special techniques to put the parts together, along with a brand. Much like Nike or Apple, a restaurant can be thought of as a design-focused brand that could contract out production.

This is where the CloudKitchens model comes in. CloudKitchens is Travis Kalanick’s rebound from Uber: a commissary kitchen that enables restaurant brands to launch without building their own physical business. Diners order the food online and it arrives on their porch; what happens in between can be a black box. The company website describes the model as “smart kitchens for delivery-only restaurants”. Just as Foxconn and other electronics manufacturing services work with many more-or-less competing OEMs (the ironically titled “Original equipment manufacturers”), a universal commissary kitchen can prepare and deliver meals on behalf of many diverse “restaurants”.

What can we expect from universal commissary kitchens in the future? First, any given facility will host many different brands/restaurants (essentially, menus). To enable maximum interoperability, brands will rely on Ikea-like instructions on screens for the assembly of menu items. Competitive advantage will go to menu designers able to create readily assembled items that consumers want (cf. Cheesecake Factory). We will see increased standardization of jobs for easy matching with workers, and most likely an increased reliance on temps recruited via apps like Pared (a kind of Uber for kitchen staff).

A logical endpoint of the evolution of this model is commissary kitchens producing diverse menus from global designers, staffed by temps who are recruited by the shift, and with delivery provided by “self-employed” vendors. (Doordash is also piloting a combination commissary kitchen/delivery service, the culinary equivalent of Fulfillment by Amazon.)

Wall Street has already rendered a positive judgment on this future. Yum China Holdings, the US-based parent of real-world restaurant chains KFC and several others in China, had revenues of $8.3bn, $784m in profits, and over 400,000 employees in 2020. Doordash had $2.9bn in revenues, losses of $461m, and just 3,279 employees globally. Yum’s market capitalization is $26bn compared with $65bn for Doordash. It seems our culinary future is platform-based and employee-lite.

As diners eventually crept back into real-world dining establishments, they discovered that most restaurants had adapted to the pandemic by posting QR codes in lieu of paper menus. In many cases, the QR code enabled diners to order and pay directly via their smartphones. Waiters and waitresses were replaced by food-runners who brought orders from kitchen to table, bypassing the usual chit-chat (and the required tip). Vendors claimed that shifting from waiters and menus to QR codes could reduce labor costs by 30 to 50% and increase the turnover of tables — an attractive option for most restaurateurs. Of course, many or most staffers could be recruited through Pared and others.

But a QR code and a generic kitchen open up intriguing possibilities. Why not shift the menu every night to a different pop-up? It could be Italian on Tuesday, Sichuan on Wednesday, Mexican on Thursday, kim-chi burritos on Friday, Thai on Saturday. Why not turn the physical space into an immobile, cuisine-agnostic food truck, advertising its menu on social media, just as actual food trucks do? In this scenario, a “menu” is just a palette of food-production algorithms that happens to light on different facilities (a commissary kitchen for delivery; a QR restaurant for dining in).

According to the CORE economics textbook, a firm is an “economic organization in which private owners of capital goods hire and direct labor to produce goods and services for sale on markets to make a profit”. By this definition, is a delivery-only restaurant a firm? The menu designers own the intellectual property (the brand and the food prep algo); the commissary kitchen owns the capital equipment; labor comes from nominally self-employed contractors (Does a recipe count as directing labor?). Much the same applies to QR facilities.

This same conundrum will apply more broadly as software eats ever more of the world. Manufacturing is headed in the direction pioneered by electronics: universal fabrication facilities capable of implementing local “recipes” sourced globally. We are already seeing a glimpse of this future on Amazon, where dozens of cryptic brands have adopted the following business model: find a product category where name-brands are still able to charge a premium, design a plausible knockoff (using free-lance designers available online), contract with a manufacturer to produce it, and use Fulfillment by Amazon to get it into the hands of consumers. The nominal industry of the product – web cams, air purifiers, cosmetics – matters little, and the “firm” can consist of a couple of people in a dorm room with a web connection, good skills at search engine optimization, and access to credit. It is as if the NBA were being replaced by pickup basketball games across the landscape.

Software is indeed eating the world — and for dessert, it is eating the basic categories we use to understand the economy, like employees, firms, industries, and nationalities. Hang on for what comes next.

Professor of Business Administration and Professor of Sociology, University of Michigan’s Ross School of Business

Jerry Davis is the Gilbert and Ruth Whitaker Professor of Business Administration and Professor of Sociology at the University of Michigan’s Ross School of Business. He has published widely in management, sociology, and finance. His latest book is Taming Corporate Power in the 21st Century (Cambridge University Press, 2022), part of Cambridge Elements Series on Reinventing Capitalism.

18 April 2024 • by Quentin Gallea in Audio articles

GenAI will allow human talent to focus on more creative, complex tasks, leading to greater job satisfaction and well-being....

Audio available

Audio available

15 April 2024 • by Annabelle Gawer in Audio articles

AI-as-a-Service will impact executives and their strategic decisions. It’s crucial to assess the benefits and repercussions it will bring....

Audio available

Audio available

9 April 2024 in Audio articles

When the going gets tough, the behavior and decisions of board members can heavily influence the fate of companies and have far-reaching repercussions. When the going gets tough, the behavior...

Audio available

Audio available

8 April 2024 • by Konstantinos Trantopoulos in Audio articles

Businesses can retain customers, attract new ones or shape their preferences by aligning key game design elements with strategic objectives....

Audio available

Audio availableExplore first person business intelligence from top minds curated for a global executive audience